Who Can Apply for a Bad Credit Car Loan?

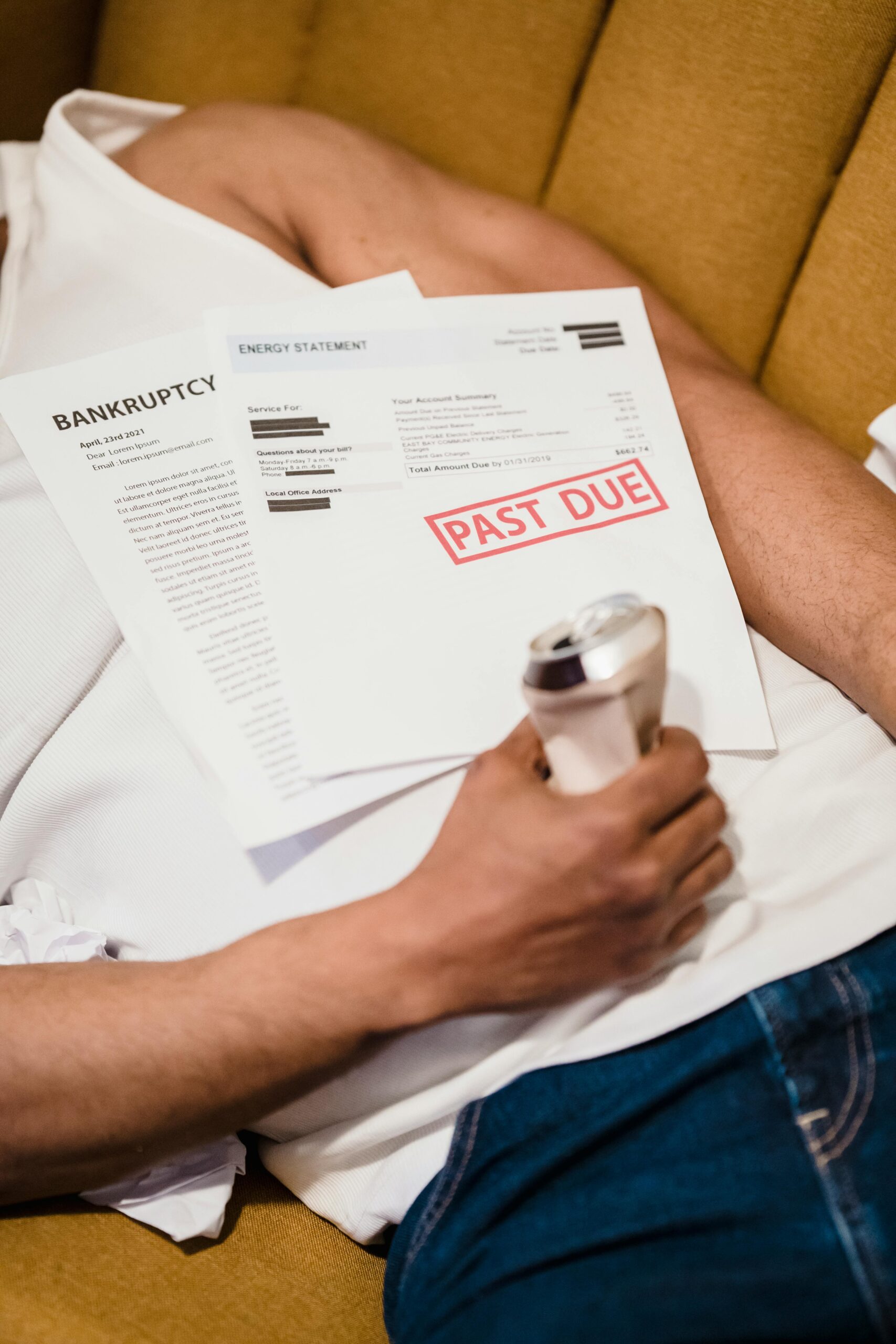

Bad credit lenders consider applicants who have had financial difficulties, as long as they can demonstrate recent stability and improved financial habits.

Generally, you may qualify if:

✔ You have a history of past defaults, late payments, or credit issues

✔ You can show improved financial conduct in recent months

✔ Your bank accounts are well-managed with no dishonoured payments

✔ Your accounts do not dip into a negative balance (unless you have an approved overdraft)

Is Approval Guaranteed?

No lender can guarantee an approval — especially in the bad-credit space.

Specialised lenders assess your situation differently from mainstream banks. Even though their criteria are more flexible, they still need to be certain that:

-

The car loan won’t cause financial hardship

-

You have enough income remaining after living expenses and repayments

-

Your recent behaviour shows responsible money management

Think of it as a “second-chance loan”: they’re willing to consider your past, but they’ll focus heavily on your present.

What Are the Eligibility Criteria?

Each provider is slightly different, but most bad-credit lenders will expect:

✔ Stable Employment

-

You must be earning a regular income

-

Employment history matters — stable work is viewed favourably

✔ Surplus Income

Lenders use an internal living-expense model based on your household situation (single, couple, dependants, etc.).

After subtracting these expenses and your proposed car loan, you must show clear surplus income.

✔ Verifiable Income

Typically required:

-

Recent payslips

-

Employment verification

-

Tax returns (if self-employed)

✔ Vehicle Restrictions May Apply

Some lenders may limit:

-

The age of the vehicle

-

Whether it’s a dealer or private sale

-

Maximum loan amounts

What Documents Do You Need?

To apply for a bad credit car loan, you’ll generally need:

-

Completed loan application & privacy consent

-

Photo ID (e.g. driver licence, passport)

-

Proof of income (payslips, tax returns)

-

Minimum 3 months of bank statements for all personal accounts

-

Statements for any current loans or credit cards

Providing accurate documents upfront helps avoid delays.

What Interest Rates Should You Expect?

Interest rates depend heavily on the severity of the credit impairment.

They may range from:

-

As low as standard car loan rates (for mild credit issues)

-

Up to around 29.90% p.a. for severe past credit problems

While higher-rate loans aren’t ideal long-term, many clients use them as a credit-rebuilding tool, allowing them to move into far better rates on their next loan once they’ve established a history of consistent repayments.

Final Thoughts

A bad credit car loan can be an effective reset — giving you access to a vehicle while rebuilding your financial reputation. The key is demonstrating genuine improvement and showing lenders you can comfortably manage repayments.

If you’re unsure where you stand, Sierra Car Loans can assess your situation without impacting your credit score and guide you toward the most suitable lending options.